Best Accounting Software in Canada

2024

Read our ultimate guide below.

Best Accounting Software in Canada

2024

Read our ultimate guide below.

In today's digital age, choosing the right accounting software is crucial for Canadian businesses, particularly those of midsize and small stature. It's not just about basic accounting tasks like invoicing and expense tracking anymore; it's also about finding software that can grow with your business, streamline processes, and remain cost-effective.

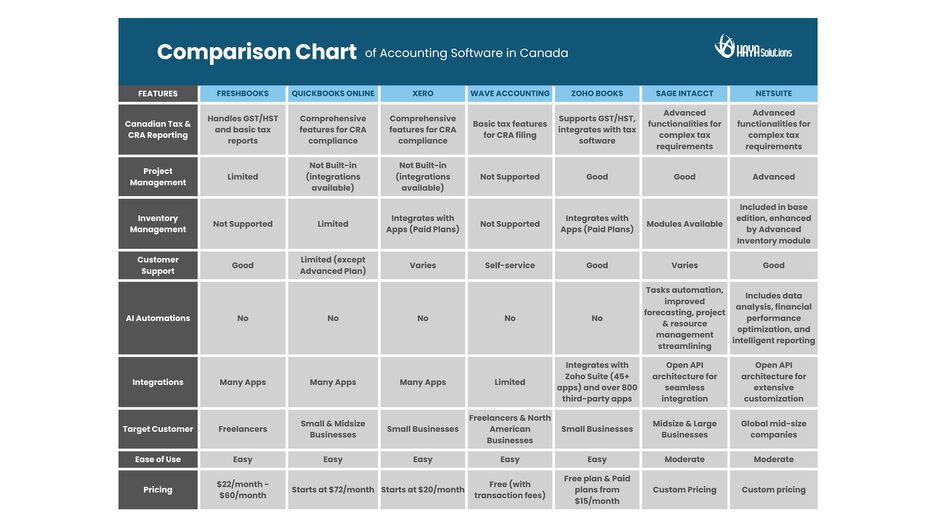

This guide compares top solutions like NetSuite, known for its support of growing businesses, and Zoho Books, valued for its affordability for small ventures. We'll also look at other contenders such as QuickBooks Online, Sage Intacct, Xero, FreshBooks, and Wave Accounting. The goal is to help you make an informed decision and choose the best accounting software in Canada to experience efficient business processes in 2024.

FreshBooks

FreshBooks stands out as a top choice for freelancers in Canada, offering tailored features to streamline accounting processes. However, it has some drawbacks compared to other options:

• Invoicing: Simplifies invoicing with customizable templates, but lacks advanced features like advanced reporting.

• Canadian Tax and CRA Tax Reporting: FreshBooks handles GST/HST and basic tax reports for Canadian small businesses filing with the CRA, but it lacks advanced tax management features and integrations with specialized Canadian tax software.

• Expenses & Time Tracking: Offers robust expense management, but lacks advanced project management tools.

• Project Management & Payments: Excels in project management, but lacks advanced integration options.

• Integrations: It integrates with various popular business apps (e.g., payment processors, CRMs, project management tools). However, compared to more robust accounting software, FreshBooks might not offer integrations for every business need.

• Pricing: Starting at $22 CAD/month for the Lite tier and $60 CAD/month for the Premium tier, FreshBooks offers a 30-day, no-risk, money-back guarantee. They also often discount their monthly pricing.

• Support: Comprehensive support services, including email, phone, chat, and live support.

Wave Accounting

Wave Accounting offers a robust suite of features at no cost, making it an attractive option for freelancers in North America. However, it has some limitations compared to other accounting software:

• Invoicing and Expense Tracking: Provides unlimited invoicing and bookkeeping for free, but lacks advanced features found in paid software.

• Canadian Tax and CRA Tax Reporting: Wave provides basic tax management features suitable for small businesses in Canada. It typically offers functionalities for tracking sales taxes and generating basic tax reports required for filing tax returns with the CRA. However, Wave lacks advanced tax management features and integrations with specialized Canadian tax software.

• Project Management: Not supported.

• Inventory Management: Not supported.

• Payment Processing and Payroll Services: Supports various payment methods, but transaction fees are higher compared to other platforms. Payroll services come with an additional monthly fee.

• Bank and Credit Card Connections: Allows unlimited connections, but lacks advanced accounting functionalities like double-entry accounting, inventory management, project accounting, and advanced reporting.

• Pricing: While Wave Accounting itself is free to use, it charges transaction fees for specific features:

▪︎ Bank payments (ACH/EFT): $1 or 1% of the transaction amount (whichever is higher);

▪︎ Credit card payments: 2.9% + $0.60 per transaction (Visa, Mastercard, Discover);

▪︎ American Express payments: 3.4% + $0.60 per transaction.

• Support: Includes self-service option with Help Centre full of articles, and community forum.

Zoho Books

Zoho Books shines as a beacon of cost-efficiency and simplicity for small businesses in Canada, offering tailored features and exceptional value. Here's why it stands out:

• Ease of Use: With a user-friendly interface, Zoho Books simplifies accounting tasks, catering to users of all skill levels.

• Canadian Tax and CRA Tax Reporting: Zoho Books provides tax management features suitable for small to mid-sized Canadian businesses. It typically offers functionalities for tracking sales taxes like GST/HST and generating tax reports required for filing tax returns with the CRA. Zoho Books integrates with Avalara AvaTax to automate sales tax calculations for your transactions. The Avalara AvaTax integration and the possibility of using Zapier offer additional features depending on your specific needs.

• Integration: Seamlessly integrates with the broader Zoho suite that contains 45+ applications for zero-code software development, email marketing, sales and marketing automation, HR, CRM, and more. It also integrates with G Suite and other third-party software that includes more than 800 apps.

• Project Management: Zoho Books offers project management features that allow you to track project costs, bill clients accordingly, and gain real-time insights into project performance.

• Inventory Management: For businesses that require dedicated inventory management, Zoho offers Zoho Inventory, which can be bundled with Zoho Books within Zoho Financials. This provides a powerful solution for comprehensive inventory control. You can track stock levels, manage purchase orders, and generate reports to optimize your inventory control.

• Pricing: Offers exceptional value with a free plan for businesses generating less than $50K USD annually. Paid plans start at $15 CAD/month, providing advanced features like project management and inventory tracking. Moreover, you can access all Zoho applications by using Zoho One which is $50 CAD per user/month.

• User Satisfaction: Boasts an impressive overall rating of 4.4 out of 5 stars on Capterra, reflecting high user satisfaction levels.

• Comparison with Other Software: Compared to alternatives like QuickBooks Online and Xero, Zoho Books excels in cost-efficiency and integration capabilities, making it ideal for small businesses in Canada.

Zoho Books emerges as cost-efficient and the best accounting software in Canada for small businesses, offering essential functionalities without imposing financial burdens, supporting growth and operational efficiency.

QuickBooks Online

QuickBooks Online offers a comprehensive solution for businesses in Canada, but it has some drawbacks compared to other options:

• Key Features Across Plans: While it offers robust features like invoicing, time tracking, and inventory management, some advanced features are only available in higher-tier plans, increasing overall expenses.

• Canadian Tax and CRA Tax Reporting: QBO offers comprehensive features for managing GST/HST, PST, and other sales taxes applicable in Canada. QuickBooks Online typically provides built-in tax reporting functionalities and integrates with various Canadian tax software solutions to streamline tax filing processes. Users can generate tax reports, file GST/HST returns electronically, and stay compliant with CRA requirements.

• Project Management: While QBO doesn't have built-in project management features, it integrates with various third-party project management applications.

• Inventory Management: QuickBooks Online offers inventory management capabilities, allowing you to track stock levels, manage purchase orders, and generate inventory reports (availability may vary depending on the plan). However, it lacks functionalities like multi-warehouse management and batch/serial tracking. Inventory management in QBO might not be suitable for businesses with high-volume inventory or intricate product variations.

• Integration and Support: QuickBooks Online integrates with many third-party apps, but may not cover all business needs. Additionally, while it offers a 30-day free trial, ongoing support is limited to the Advanced plan.

• Plans and Pricing: Pricing starts at $72/month for the best value plan, but costs can add up as more users and features are needed. Their pricing often decreases or increases, and it depends on when you sign up in this cycle.

While QuickBooks Online is a choice of many small businesses for their accounting needs, businesses need to consider the duration of support. Businesses migrate from QuickBooks Desktop to QuickBooks Online as it will discontinue on 31 May 2024. This includes all 2021 versions of QuickBooks Desktop Pro, Premier, Enterprise Solutions, and Accountant Edition 2021.

Xero

Xero presents a compelling accounting option for Canadian businesses, offering comprehensive features and competitive pricing. However, it has some drawbacks compared to other options:

• Comprehensive Features and Pricing: Offers versatility and affordability with plans starting at $20 CAD/month, but some advanced features may require higher-tier plans, increasing overall costs. Monthly pricing often fluctuates to be decreased or increased based on the demand.

• Canadian Tax and CRA Tax Reporting: It offers comprehensive features for managing GST/HST, PST, and other sales taxes applicable in Canada. Xero typically provides built-in tax reporting functionalities and integrates with various Canadian tax software solutions to streamline tax filing processes. Users can generate tax reports, file GST/HST returns electronically, and stay compliant with CRA requirements.

• Project Management: While Xero doesn't have built-in project management functionalities, it excels in integrations. You can connect Xero with numerous third-party project management applications.

• Inventory Management: Xero integrates seamlessly with inventory management applications within its paid plans.

• User Satisfaction: While it enjoys high user satisfaction ratings, some users have reported issues with customer service and discontinued integrations.

• Integration and Security: Integrates with over 800 third-party apps and ensures robust cloud security, but may not cover industry-specific integrations and functionalities.

In comparison to competitors like NetSuite and Zoho Books, Xero offers affordability but may have limitations in customer service and industry-specific functionalities.

Sage Intacct

• AI-Powered Enhancements: Sage Intacct leverages artificial intelligence to automate tasks, improve forecasting, and streamline project & resource management. This can significantly boost productivity.

• Canadian Tax and CRA Tax Reporting: It provides advanced functionalities for managing complex tax requirements, including GST/HST, PST, and other sales taxes applicable in Canada. Sage Intacct integrates with various Canadian tax software solutions and provides comprehensive tax reporting capabilities to ensure compliance with CRA regulations. Users can generate detailed tax reports, file tax returns electronically, and manage tax audits.

• Project Management: Sage Intacct empowers businesses with robust project management features, enabling them to track project costs and resource allocation effectively through detailed budgeting tools. Real-time progress insights and comprehensive reports help identify potential issues early and measure project success.

• Inventory Management: While inventory management isn't directly included in Sage Intacct's core platform, additional modules offer comprehensive functionalities. These modules can track stock levels across locations, utilize various costing methods for accurate valuation, and streamline purchase orders with automated reorder points, ultimately enhancing inventory control and vendor relationships.

• Learning Curve: Fully utilizing AI features might require additional training for your accounting team to understand and leverage them effectively.

• Open API Architecture: Sage Intacct offers a highly customizable platform with an open API. This allows for seamless integration with various third-party applications and existing business systems.

• Technical Expertise Needed: Building custom integrations often require technical knowledge or hiring developers, which can be a barrier for some businesses.

• Limited Industry-Specific Tools: While versatile, Sage Intacct might not have highly specialized features tailored to very specific industries like manufacturing or healthcare.

• Custom Pricing: Sage Intacct doesn't have a fixed pricing structure. Costs are determined based on your specific business needs and the functionalities required. This can make it difficult to budget for, compared to software with set pricing tiers.

• Scalability for Growth: While powerful, Sage Intacct is primarily designed for midsize and large businesses with complex accounting requirements. Its extensive features and customization options might be overwhelming for smaller businesses with simpler accounting needs.

NetSuite

NetSuite excels as the premier choice for global mid-size companies aiming to expand, offering tailored solutions to meet complex business and industry-specific needs. Here's why it stands out:

• NetSuite Enterprise Performance Management (EPM): Connects planning, budgeting, forecasting, and reporting processes for seamless information flow.

• Canadian Tax and CRA Tax Reporting: NetSuite offers robust tax management features suitable for mid-sized to large Canadian businesses. It typically provides comprehensive functionalities for managing various taxes applicable in Canada, including GST/HST, PST, and other sales taxes. NetSuite integrates with various Canadian tax software solutions and provides extensive tax reporting capabilities to ensure compliance with CRA regulations. Users can generate detailed tax reports, file tax returns electronically, and manage tax audits.

• Project Management: NetSuite's project management equips businesses for growth by providing advanced functionalities. You can track project costs and resources effectively, collaborate seamlessly with teams through centralized information access and built-in communication tools, and gain real-time insights into project progress to identify and address potential issues early on. This translates to improved project delivery, better resource allocation, and ultimately, increased profitability.

• Inventory Management: NetSuite has best-in-class inventory management, included in the base edition and further enhanced by the Advanced Inventory module. It offers features for multi-location stock level tracking to prevent stockouts and optimize ordering. You can leverage various costing methods for accurate inventory valuation and financial reporting. Additionally, NetSuite streamlines the purchase order process with automated reorder points, enhancing inventory control and vendor relationships.

• Rich in Industry-Specific Tools: NetSuite goes beyond core functionalities by offering industry-specific modules that cater to specialized needs. For instance, manufacturers can leverage modules for production planning, quality control, and compliance management. Similarly, retailers might benefit from features like omnichannel sales management and loyalty program integrations. These add-on modules ensure that NetSuite adapts to your specific industry's workflows and challenges, fostering a truly comprehensive financial management solution.

• Intelligent Performance Management (IPM): Utilizes data science to optimize financial performance and strategic planning.

• Profitability and Cost Management Reporting: Provides deep insights for informed decision-making.

• Automated Account Reconciliation: Simplifies reconciliation processes, reducing manual effort and errors.

• Close Management and Consolidation: Ensures compliance and reduces financial discrepancies.

• Generative AI for Content Creation and Narrative Reporting: Facilitates personalized content creation and reporting directly from NetSuite data.

• Predictive Algorithms: Identifies trends and insights for proactive financial management.

• Streamlined Reporting: Offers efficient reporting processes for tax preparation and financial storytelling.

• NetSuite's pricing is tailored to your business. They use a tiered subscription model with costs based on features, users, and any needed customization. While there's no one-size-fits-all price tag, NetSuite prides itself on transparent pricing with no hidden fees.

In comparison to alternatives like QuickBooks Online, Xero, and Sage Intacct, NetSuite is known as the best accounting software in Canada for growing businesses and stands out for its comprehensive features, AI-driven enhancements, and seamless integrations. With its robust solution, NetSuite addresses current financial needs while anticipating future challenges, making it ideal for growing businesses seeking scalability and efficiency. NetSuite evolves and adapts new technologies, check out what is new in NetSuite 2025 release.

What is the best accounting software in Canada?

QuickBooks Online, Xero, FreshBooks, Sage Intacct, Wave Accounting, Zoho Books, and NetSuite are widely favored.

Which accounting software do professional accountants often recommend? Professional accountants typically suggest software that is comprehensive, user-friendly, and versatile. Recommendations may vary depending on specific business needs and the accountant's own experience.

What factors should I consider when choosing new accounting software? When selecting accounting software, consider these seven factors:

• Budget: Ensure it fits within your financial constraints.

• Learning curve: Assess how easy it is to use.

• Features: Check if it has all the necessary features.

• Integrations: Look for compatibility with other tools.

• Reporting capabilities: Ensure it can generate required reports.

• Accounting method: Decide between cash and accrual accounting.

• Scalability: Choose software that can grow with your business.

Get a free consultation to discover the best accounting software for your business.