NetSuite vs Sage vs Zoho One: In-Depth ERP Comparison for Small Businesses

Introduction

Choosing the right ERP system for a small business is a critical decision that can impact every aspect of operations, from accounting and inventory management to CRM and eCommerce. In this comprehensive comparison, we dive deep into three popular ERP solutions – Oracle NetSuite, Sage Intacct (a cloud ERP from Sage), and Zoho One – to help small businesses determine which platform best fits their needs. We provide a feature-by-feature breakdown of each platform, discuss implementation challenges, explore industry-specific use cases, highlight real-world case studies, and analyze the cost-benefit of each solution. We also compare their integration capabilities with third-party applications. By the end of this article, you’ll have a clearer understanding of NetSuite vs Sage vs Zoho One and which ERP might be the best choice for your small business.

Overview of the ERP Platforms

Before delving into detailed features, let’s briefly introduce each platform and its overall positioning for small businesses:

NetSuite (Oracle NetSuite)

A leading cloud-based ERP solution known for its comprehensive suite that covers financials, supply chain, CRM, eCommerce, and more. NetSuite is often considered an all-in-one ERP for growing companies and is used by over 38,000 customers across 20+ industries. It’s robust and scalable but usually comes with a higher price tag and complexity. Plans typically start around $999 monthly for the base platform, making it a significant investment for a small business. NetSuite is designed to streamline operations with real-time visibility across the entire business, but the depth of functionality means implementation must be planned carefully.

Sage Intacct (Sage)

Sage Intacct is a cloud-based financial management and accounting-focused ERP, popular among small and mid-sized businesses for its strong core financial features. It offers modules for accounting (AP/AR), cash management, order management, purchasing, project accounting, and built-in reporting and dashboards. Sage Intacct is known for its ease of use and quick deployment for finance teams. It’s often praised for high customer satisfaction in the cloud ERP space. However, Sage Intacct has a narrower scope compared to NetSuite – it’s mainly a best-in-class accounting solution and lacks some broader ERP components like built-in CRM or eCommerce. Companies needing those functions may need to integrate Sage Intacct with other systems. In terms of cost, Sage Intacct’s pricing is modular and generally more affordable than NetSuite. However, it can increase as you add users and additional modules; it’s typically sold as an annual subscription via Sage partners (exact pricing varies).

Zoho One

Zoho One is an all-in-one business suite rather than a traditional ERP. Still, it provides an integrated set of 45+ applications that cover virtually every business function – from accounting and inventory to sales, marketing, HR, and more. Dubbed “the operating system for business,” Zoho One is beautiful to small businesses due to its low cost (around $30 per user/month) and broad features coverage. Zoho One includes apps for CRM, finance (Zoho Books), inventory, project management, analytics, and even website building. It’s designed to be easy to use and quick to set up, with a user-friendly interface across its cloud apps. The trade-off is that while Zoho One offers many features, some of its components might not be as deep or advanced as the specialized modules in NetSuite or Sage. However, for a small business with a limited budget looking for broad functionality out of the box, Zoho One presents a compelling choice.

Now, let’s examine each platform's features in more detail and compare them.

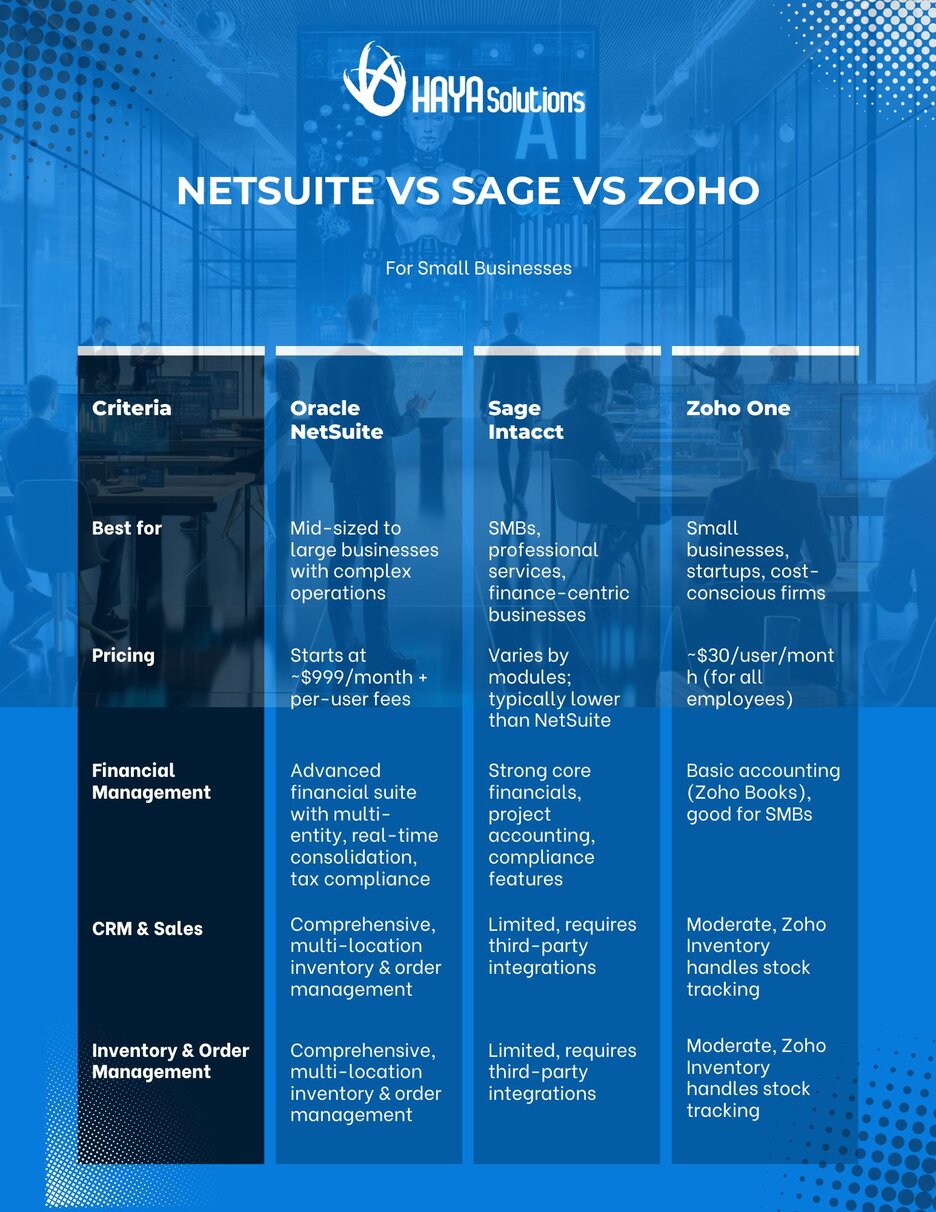

Feature-by-Feature Breakdown

Financial Management and Accounting

NetSuite: NetSuite started as a financial management solution and excels in this area. It provides a full suite of accounting features: general ledger, accounts receivable (AR), accounts payable (AP), tax management, fixed assets, and multi-currency capabilities. A standout feature is NetSuite’s ability to handle multi-subsidiary consolidations and multi-currency accounting in real-time – ideal for businesses with multiple entities or global operations. NetSuite offers robust revenue recognition (important for subscription businesses or those following complex accounting standards) and strong budgeting/forecasting tools. Financial reporting in NetSuite is compelling, with customizable reports and dashboards that can give live insight into KPIs. The platform’s real-time visibility means you can see their impact on financial statements when transactions are entered (sales, invoices, expenses). This helps in faster decision-making. NetSuite’s financial capabilities are integrated with all other modules (inventory, sales, etc.), ensuring that accounting is always in sync with operations.

Sage Intacct: As an accounting-centric solution, Sage Intacct’s core strength is financial management. It provides robust GL, AR, AP, cash management, and project accounting features that are out of the box. Intacct supports dimensional accounting (tags like location, department, project, etc. on transactions), which gives flexibility in reporting – for example, nonprofits use dimensions for fund accounting. It has strong revenue management for services companies and robust financial reporting with drill-down dashboards. Sage Intacct also includes budgeting and planning tools (though less extensive than NetSuite’s suite) and can automate many finance processes. A key limitation to note is that Sage Intacct focuses on finance and does not include many non-financial modules natively – for instance, it lacks modules for inventory management, warehouse management, or manufacturing within the core product. Those would require third-party add-ons or integrations. Sage Intacct is often paired with Salesforce for CRM (Sage provides a pre-built connector for Salesforce CRM), highlighting that its feature set beyond accounting may rely on integration rather than native functionality. For a small business primarily concerned with best-in-class accounting and financial controls, Intacct offers rich features and reliable performance in that domain. It’s also praised for its intuitive interface and role-based dashboards, making it easier for teams to adapt quickly.

Zoho One: Zoho One includes Zoho Books for accounting and finance, which covers basic accounting needs like invoicing, expense tracking, accounts receivable/payable, and financial reporting. For many small businesses, Zoho Books is sufficient. However, it may not have the advanced financial management features that larger enterprises require (for example, multi-entity consolidation is not as seamless as NetSuite). Zoho One’s strength is that it ties the accounting app with other apps like CRM, Inventory, and Subscription management. You get features like quote-to-cash process integration: leads in Zoho CRM can be converted to deals, then invoices in Zoho Books, etc., all within one ecosystem.

Inventory management is handled by Zoho Inventory, which is part of Zoho One. It supports order management, warehouse stock tracking, and e-commerce platform integration. While Zoho’s finance suite (Books, Invoice, Inventory, Subscription) is quite capable for small companies, it might lack advanced capabilities like complex revenue recognition or multi-currency consolidations that larger companies need. However, Zoho is continually adding features, and its suite approach means even the financial data can be easily used in Zoho’s analytics app for reporting. Also, Zoho’s Analytics app allows the creation of BI dashboards pulling data from various Zoho apps (and even external sources), which can compensate for some reporting limitations in Zoho Books itself. Overall, Zoho One provides a broad but shallow range of financial features – enough for many small businesses, especially those upgrading from essential tools like QuickBooks, but not as deep as NetSuite or Intacct in high-end financial management.

Customer Relationship Management (CRM) and Sales

NetSuite: NetSuite includes an integrated CRM module that covers lead and opportunity management, customer records, sales pipeline tracking, and customer support cases. Its CRM is tightly unified with financials and fulfillment – for example, sales orders flow directly into invoicing and revenue recognition. NetSuite’s CRM may not be as feature-rich in marketing automation as dedicated CRM platforms like Salesforce or Zoho CRM. Still, it provides all the core sales force automation features a small or mid-sized business would need. A benefit of NetSuite’s CRM is that account data, order history, and financial transactions are all in one system, providing a 360-degree view of the customer. If a small business places heavy emphasis on CRM capabilities (like advanced campaign management or intricate sales workflows), they might find NetSuite’s CRM somewhat limiting compared to best-in-class CRMs. However, for many, the convenience of a single system outweighs any feature gaps. NetSuite also offers a module called SuiteCommerce for eCommerce, meaning your online store orders and customer web activity can tie back into the same CRM/ERP database. This is valuable for retail or wholesale businesses that want integrated eCommerce and customer data.

Sage Intacct: Sage Intacct does not include a native CRM. Instead, it relies on integration with external CRM systems. Sage officially touts integration with Salesforce CRM (as mentioned above), allowing Salesforce sales teams to connect with the finance data in Intacct. This means a small business using Sage Intacct will need a separate CRM to manage leads and customer relationships (unless they only need fundamental customer records in the accounting system). This separation can be a consideration for businesses in the service industry or those that choose Sage Intacct for their finances: maintaining two systems (CRM and ERP) and ensuring they sync correctly. Some Sage users might opt not to use a complete CRM if their needs are simple, but growth often necessitates one. This is a clear difference in the feature set: Intacct focuses on accounting and relies on third-party CRM and sales automation solutions. On the plus side, by integrating a dedicated CRM (like Salesforce or others), businesses can have best-of-breed in both areas, though it introduces integration work.

Zoho One: One of Zoho One’s most potent components is Zoho CRM, a popular stand-alone CRM in its own right. Zoho CRM (included in Zoho One) is a fully-featured CRM platform covering lead and contact management, deal tracking, workflow automation, marketing campaigns, customer support (with Zoho Desk integration), and more. Small businesses will find Zoho CRM comparable to leading CRM systems, with advantages like an easy-to-use interface and the ability to customize fields, pipelines, and automation. Because it’s part of the Zoho One suite, it natively connects with Zoho Books (accounting) for quote/invoice data, Zoho Projects for project delivery after a sale, Zoho Campaigns for email marketing, etc. This means out-of-the-box connectivity between your sales process and other departments. For example, when a deal closes in Zoho CRM, you can automatically create a project in Zoho Projects or an invoice in Zoho Books. The tight integration of CRM with other apps is a big selling point of Zoho One as an ERP suite for small businesses. Additionally, Zoho CRM has a robust mobile app and dozens of extensions (including one for Gmail/Outlook and others from the Zoho Marketplace) to extend functionality. In summary, Zoho One excels in CRM and sales features for small businesses, arguably more so than NetSuite or Sage Intacct, because Zoho’s CRM is a mature, dedicated product.

Inventory, Order Management, and Manufacturing

NetSuite: NetSuite is well known for its substantial inventory and order management capabilities – a key reason product-based businesses choose it. It supports end-to-end order fulfillment: sales orders, pick/pack/ship processes, drop shipments, and returns. NetSuite’s inventory management is multi-location, meaning a small business with multiple warehouses or retail stores can track stock levels at each location in real-time. It also handles assembly builds and light manufacturing via work orders and a module for manufacturing resource planning (MRP). NetSuite has a manufacturing module for more complex production that can manage BOMs (Bill of Materials), production scheduling, and capacity planning. Warehouse management features (like directed putaway and picking) are available with add-ons (e.g., NetSuite WMS)

Another notable feature is that NetSuite can unify eCommerce with inventory; its SuiteCommerce or Shopify integration ensures online orders decrement inventory instantly and is reflected in financials. In short, NetSuite provides a comprehensive solution for companies that deal with physical products – covering procurement, inventory control, and fulfillment in one system. This is often beyond the scope of what Sage Intacct or Zoho natively provide.

Sage Intacct: Out-of-the-box, Sage Intacct’s inventory and order management capabilities are limited compared to NetSuite. Sage Intacct can handle order management by processing sales orders to invoices (useful for service or software companies or simple product sales). Still, it does not have robust native inventory tracking for complex multi-warehouse scenarios or manufacturing management in its core modules. Sage offers an Inventory module (often an add-on) to manage stock levels. Still, many product-centric companies using Intacct opt to integrate a specialized inventory management or warehouse management system. Similarly, for manufacturing, Sage Intacct is not designed to run a factory floor or production planning; manufacturers would likely need a separate MRP system or consider a different ERP. For small distribution or retail companies, Sage Intacct can manage the financial side of purchasing and sales and track inventory value, but the operational logistics might require integration. Sage has a marketplace of partners (for example, integration with applications like Sage Inventory Advisor or others) to extend these functions. So, while Sage Intacct can be part of a solution for inventory-based businesses, it typically requires more integration effort, unlike NetSuite, which can handle much of it natively.

Zoho One: Zoho One includes Zoho Inventory, which provides inventory management for small to mid-sized needs. With Zoho Inventory, businesses can track stock levels, manage items across multiple warehouses, handle purchase orders, and process sales orders and shipments. It also integrates Zoho’s eCommerce and sales channels. For example, you can connect Zoho Inventory with Amazon, eBay, Shopify, etc., to synchronize online orders and inventory. This makes Zoho One a viable option for a small retail or e-commerce business needing a unified system. However, Zoho Inventory is intended for relatively straightforward inventory needs. It supports bundling items (light kitting) but is not a complete manufacturing solution – it won’t handle complex production scheduling or BOMs beyond essential bundle items. It could suffice for companies with simple assembly or kitting, but manufacturers will find Zoho One lacking. On the plus side, Zoho Inventory combined with Zoho Books means the financial side (inventory valuation, cost of goods sold, etc.) is automatically integrated. And like other Zoho apps, it’s user-friendly and works well for a small business environment. Zoho Creator (a low-code app builder included in Zoho One) could be used to build custom manufacturing workflows if needed, but that requires some development effort. In summary, Zoho One covers the basics of inventory and order management out-of-the-box and is sufficient for many trading or retail small businesses. Still, it’s not meant for heavy manufacturing without customization.

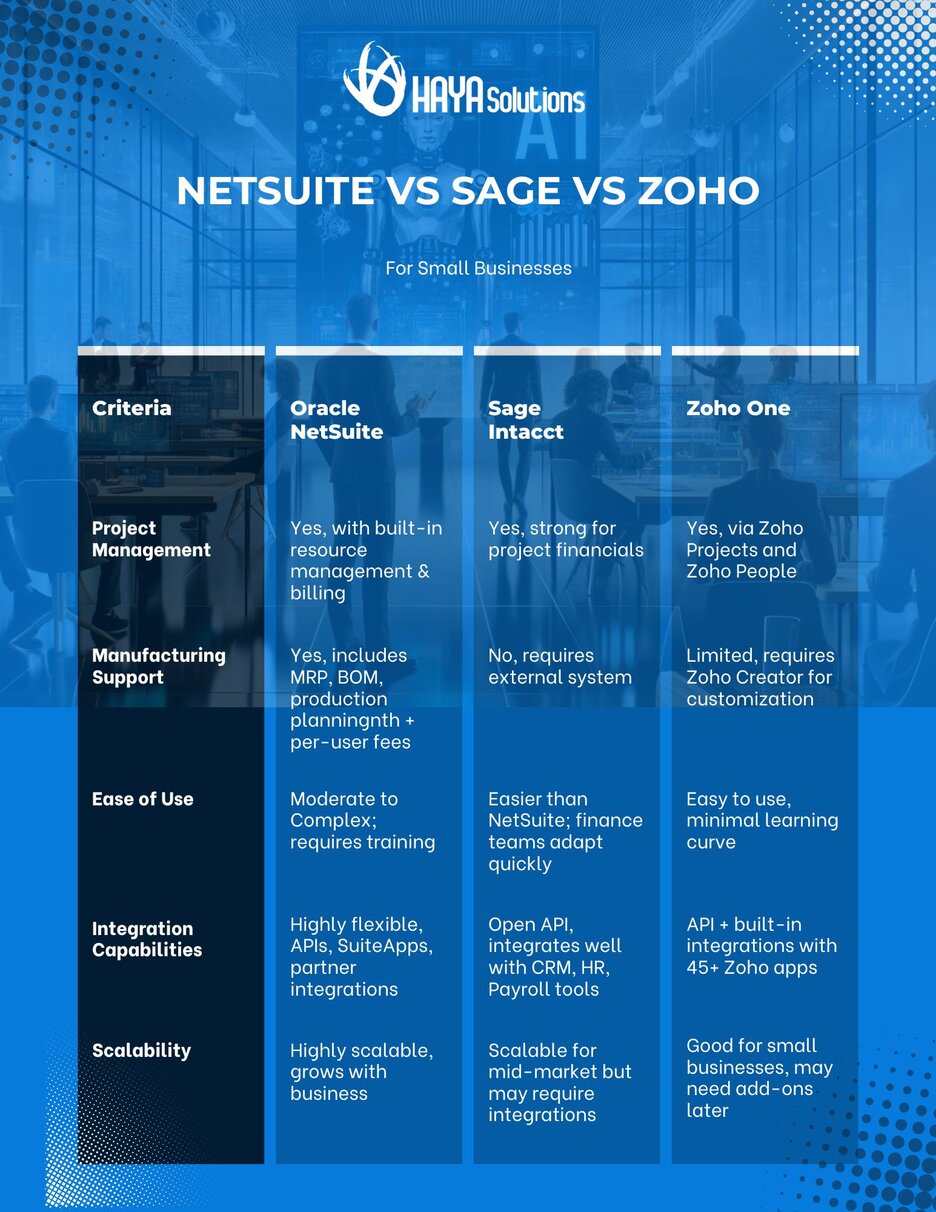

Reporting and Analytics

NetSuite: NetSuite offers very robust reporting and analytics capabilities. Users can create saved searches (custom queries) and reports for nearly any data in the system. It includes dozens of standard reports for financials, sales, inventory, etc., which can be customized or used to generate real-time dashboards. NetSuite’s dashboards can display KPI meters, trend graphs, and reminders (tasks) that update live as transactions occur. For deeper analysis, NetSuite has an Analytics Warehouse (an additional module) and a SuiteAnalytics Workbench for multi-dimensional analysis. Many small businesses might not need those advanced tools initially, but they highlight NetSuite’s capacity to scale in analytics. Importantly, NetSuite provides advanced analytics and reporting with customizable dashboards out-of-the-box – this means even a small business owner or CFO can get a comprehensive view of operations (like cash flow, sales by region, inventory turnover, etc.) in one place. The ability to drill down from a high-level KPI to the underlying transactions is beneficial for troubleshooting and understanding performance drivers. NetSuite’s reporting is also fully integrated, so reports can span across modules (e.g., a single report could show a customer’s sales, invoices, and support cases). The downside is that mastering NetSuite’s reporting tools may require some training due to their breadth.

Sage Intacct: Sage Intacct is well-regarded for its financial reporting. It provides a tool called Intacct Financial Report Writer, which lets users create custom financial statements and reports using the dimensional data model. Intacct’s dashboards are also quite user-friendly and can be tailored by role – for example; you might have a CFO dashboard showing high-level financial health metrics and a sales manager dashboard showing bookings vs. budget. Intacct can also perform consolidation reporting for multi-entity companies, though the process might not be as instantaneous as NetSuite’s real-time consolidation. One limitation is that because Intacct is finance-focused, its reporting is most potent; if you integrate other systems (like a separate CRM), you won’t automatically get unified reports without using an external BI tool or additional integration. However, for pure accounting and financial analysis, Sage Intacct provides comprehensive reporting and even AI-powered insights in recent releases (such as anomaly detection in expenses, etc.). Many nonprofits and companies with complex reporting needs choose Intacct for its ability to manage grant tracking or project accounting reporting (as seen in case studies where Intacct saved significant time in preparing reports)

sockeyeconsulting.com. In a nutshell, Intacct’s built-in analytics are excellent for financial data, with real-time dashboards and the ability to slice and dice accounting data. Additional tools might be needed for non-financial metrics.

Zoho One: Zoho One includes Zoho Analytics, a business intelligence and reporting tool, which is a strong point of the suite. Out of the box, each Zoho app (Books, CRM, etc.) has its standard reports and even some basic dashboards. For example, Zoho Books can show P&L statements and Zoho CRM can show sales funnel charts. Zoho Analytics takes it further by allowing you to combine data from multiple Zoho apps (and even external sources like Excel or third-party databases) to create custom reports and dashboards. This is very powerful for a small business solution because it provides a way to achieve a unified view. With Zoho One, you can aggregate data from marketing, sales, operations, and finance into a single dashboard on Zoho Analytics. The analytics tool provides a drag-and-drop interface for creating charts and supports SQL for advanced queries if needed. It even offers some AI-assisted analysis through a feature called Zia Insights, which can generate narrative explanations of trends. The catch is that you have to configure Zoho Analytics to pull the data and set up those dashboards – it’s not as automatically unified as NetSuite’s internal reporting (since NetSuite is one system, whereas Zoho is a suite of separate apps connected). Still, the breadth of data available in Zoho One and the included analytics capabilities are a huge benefit, especially given the low cost of the suite. Small businesses can get enterprise-like BI without investing in a separate BI tool. Regarding ease, Zoho’s reports are generally user-friendly, but consolidating data from different modules may require some initial setup. Overall, Zoho One provides good reporting tools, and its integrated nature means most of what a small business needs to analyze (sales, expenses, website traffic, etc.) can be done within the platform.

Customization and Scalability

NetSuite: NetSuite is highly customizable. It allows adding custom fields, forms, and workflows without coding, and for deeper customization, it has a scripting language (SuiteScript) and a robust API. Many small businesses start with a relatively standard NetSuite configuration but take advantage of custom workflows (for example, to automate an approval process) as they grow. NetSuite also has an extensive marketplace of third-party apps (SuiteApps) where you can find extensions for specific needs (like advanced warehouse scanners or industry-specific modules). Scalability is one of NetSuite’s hallmarks – it can support a company from the startup stage to a large enterprise, which means a small business can grow on the platform without outgrowing it. However, the flip side is that initial implementation can be complex, and over-customization can lead to maintenance challenges. NetSuite’s cloud infrastructure handles performance and scaling behind the scenes (so you don’t worry about servers), and it performs well for most small to mid-size workloads. Given Oracle’s backing, the system is reliable even as transaction volumes increase. In short, NetSuite offers virtually unlimited customization and scalability, but small businesses should govern this with best practices to avoid making the system too complex for their teams.

Sage Intacct: Sage Intacct allows customization, particularly in reports and workflows, and integrates add-on modules. It is not as open-ended as NetSuite regarding adding entirely new functional modules (since Intacct focuses on financials). You can add user-defined fields and some process customizations, and there is a marketplace of partner-developed extensions for specific needs. Sage’s approach is more configurative than programmatic – meaning you configure settings and use its features as designed rather than writing a lot of custom code. This can be an advantage for small businesses that don’t have IT resources; the system is less likely to require heavy technical tweaking. In terms of scalability, Sage Intacct can handle mid-market companies comfortably. Still, if a business grows into needing a complete ERP with manufacturing or extensive omnichannel commerce, it might hit the upper limits of what Intacct was designed for. That said, for many small to medium businesses, Intacct scales quite well regarding the number of users and transaction volume on the financial side. It also has regular updates (four major releases per year) introducing enhancements, which means the product continuously improves without the customer needing to do the heavy lifting. As an example of scope, Intacct is often chosen by companies with up to a few hundred employees or more, especially those wanting strong financial controls without an oversized ERP. If your growth leads you to need modules outside Intacct’s wheelhouse, you might consider switching (as some do to NetSuite for a more comprehensive suite, evidenced by comparing the two).

Zoho One: Zoho One is surprisingly flexible for a small business suite. Each Zoho application in the suite has its own settings and customization options – for instance, Zoho CRM allows custom modules and fields, Zoho Books allows custom invoice templates, etc. Additionally, Zoho provides Zoho Creator (a low-code platform) as part of Zoho One, which means a tech-savvy user can build custom applications or extensions not covered by the standard apps. This is a powerful way to fill gaps with tailor-made mini-apps that live in the Zoho cloud and integrate with the rest. Zoho’s ecosystem also has APIs for all its apps, so if needed, a developer can integrate external systems or build custom automation. Many small businesses appreciate that they can start with mostly off-the-shelf functionality in Zoho One and gradually add customization. For example, you could create a custom app in Zoho Creator to manage a specialized workflow (say, a warranty tracking system) and connect it to Zoho CRM to tie warranties to customer records.

Regarding scalability, Zoho One can also support businesses with hundreds of employees. Still, one must consider that large or complex organizations might eventually need more advanced systems. However, Zoho One’s unlimited scalability claim means adding as many users and data as needed (subject to subscription terms) without performance issues – the underlying infrastructure is cloud-scaled for all customers. The primary scalability limitation would be if you require features Zoho doesn’t offer (like advanced MRP, etc.), but not so much the number of users or data volume. Also, the suite keeps evolving because Zoho frequently updates its applications (often on a monthly or bi-monthly cycle for cloud apps). Overall, Zoho One offers a blend of easy startup and later customization, allowing small businesses to grow and adapt the software to their processes.

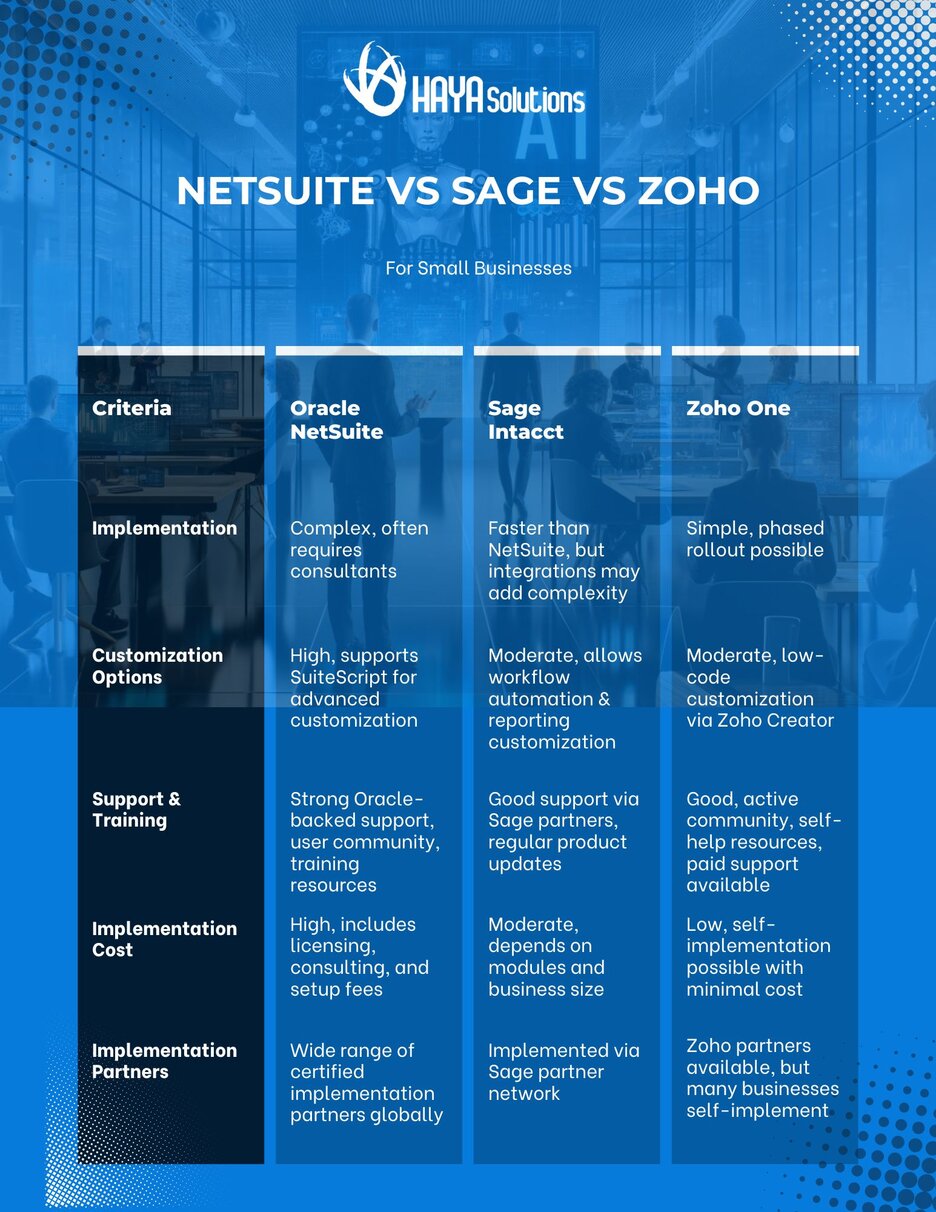

Implementation Challenges and Considerations

Implementing an ERP system is a significant project for any small business. Each of these platforms comes with its implementation challenges and considerations:

NetSuite Implementation:

NetSuite is a powerful system, but implementing it can be complex and usually requires expert help. Small businesses often work with NetSuite Solution Providers or consultants (like Haya Solutions’ NetSuite Professional Services) to configure the system to their needs. A typical NetSuite implementation might take several months, involving phases for requirement analysis, configuration, data migration, user training, and testing. One challenge is data migration – moving data from legacy systems (e.g., QuickBooks or Excel sheets) into NetSuite’s structure for customers, financials, inventory, etc. NetSuite provides import tools, but data cleansing and mapping can be time-consuming. Another consideration is that NetSuite, being so feature-rich, requires you to define your processes clearly: for example, how you want sales orders to flow, how inventory is managed, approval workflows, and so on. Without clarity, you might under-utilize or misconfigure the system. User training is vital because NetSuite will likely be more complex than the spreadsheets or essential software many small businesses start with. The upside is that Oracle NetSuite offers methodologies like SuiteSuccess (pre-configured industry solutions) to accelerate deployment, and it has extensive online help and a user community. Still, small businesses should be prepared for a learning curve. Budget-wise, beyond licensing, implementation services fees can be significant – sometimes equal to or greater than the first year’s software cost, depending on complexity. Planning for ongoing support is also crucial: who will administer the system, manage updates (NetSuite has two major updates per year), and handle user requests. Despite these challenges, a successful NetSuite implementation can transform a business – automating many processes and providing new insights – often leading to a high ROI over time.

Sage Intacct Implementation:

Implementing Sage Intacct tends to be more straightforward than NetSuite in many cases, primarily because the scope (financials) is narrower. Many Sage Intacct implementations for small businesses focus on replacing an accounting system like QuickBooks with Intacct, so they revolve around migrating accounts' charts, opening AR/AP, and configuring financial reports. Sage partners often can deploy core financials in weeks, not months, if the requirements are standard. However, if a business also needs to integrate Intacct with other systems (CRM, payroll, inventory management software, etc.), that adds complexity. A consideration is that Sage Intacct, while user-friendly, still requires training, especially if users are not familiar with accrual accounting or multi-dimensional reporting. One challenge noted by some users is integration setup – for example, connecting Sage Intacct to a CRM or an eCommerce system might require a middleware or technical effort, which can be complex and time-consuming. Data migration into Intacct (e.g., bringing over historical financial data) should be carefully planned to ensure accuracy in the new system. Another implementation aspect is designing the dimensions (if used) – thinking through how you want to tag transactions with departments, locations, classes, etc., to maximize reporting capabilities. Since Intacct releases updates four times a year, part of the deployment strategy should include staying informed and taking advantage of new features (usually, the updates are automatic in the cloud, but new features might be optional to enable). Compared to NetSuite, Sage Intacct projects usually have a lower learning curve and faster go-live for core use. Still, the challenge can be ensuring all needed business processes are covered. If something isn’t handled in Intacct (a field service management process), you need to implement a separate tool and integrate it, which means effectively implementing multiple systems. Identifying these gaps and involving the proper integration solutions or partners is key.

Zoho One Implementation:

Zoho One positions itself as easy to implement, and in many cases, a small business can start using some Zoho apps almost immediately. For example, one can sign up and, within a day, start sending invoices via Zoho Books or managing leads in Zoho CRM. The challenge with Zoho One is not initial setup (which is relatively straightforward for individual apps) but instead orchestrating all the apps you plan to use and integrating them into your business processes. Zoho provides an admin panel to manage users and which apps they can access, simplifying user management. Data migration into Zoho apps can range from easy (importing contacts via CSV into Zoho CRM is simple) to moderate (importing entire accounting history into Zoho Books might require careful mapping). Zoho has migration tools for popular software (e.g., QuickBooks to Zoho Books migration wizards). A notable implementation consideration is process alignment: since Zoho One offers so many apps, you should initially decide which ones you need. It might be tempting to use everything, but it’s often best to phase the implementation (for instance, start with CRM and Books, add Inventory, add Projects, etc.) to allow your team to adapt gradually. Each Zoho app, while more manageable than a giant ERP module, still has its learning curve. Training employees on multiple new applications at once can overwhelm them. On the positive side, Zoho One’s interface is generally intuitive and user adoption tends to be smooth for tech-savvy teams. Implementation might involve customization work – e.g., customizing form fields or automation rules in Zoho CRM to match your sales process – but these can typically be done without coding. Another consideration is that if you require specific features or complex workflows, you might end up engaging a Zoho Partner (like Haya Solutions, which offers Zoho consulting and implementation services) to do advanced setup or custom development (for example, using Zoho Creator to build a custom app for your needs). Overall, small businesses often find they can get Zoho One up and running quickly, achieving essential integration between apps out-of-the-box (Zoho has pre-built integrations among its products). Change management is still essential: even if the software is affordable and available, ensuring your team uses the CRM consistently or logs time in Zoho Projects might require management effort. In summary, Zoho One’s implementation is usually the least intimidating of the three – designed for simplicity – but making the most of the full suite will require a structured approach and possibly some expert guidance for optimal results.

Industry-Specific Use Cases

Each of these ERP solutions has strengths in specific industries, and small businesses should consider how well the software aligns with their industry-specific requirements:

Wholesale and Distribution:

NetSuite is often a top choice for companies that buy and sell products (wholesale distributors, import/export businesses, etc.). Its robust inventory, order management, and procurement features allow distributors to manage stock levels, handle purchase and sales orders, and even run an integrated eCommerce storefront if needed. NetSuite’s ability to manage multiple warehouse locations and to automate reordering points is beneficial in distribution. Additionally, many wholesale/distribution small businesses eventually expand to multiple regions or channels; NetSuite can handle multi-subsidiary accounting if you open a new branch or even an overseas entity. Sage Intacct can also serve distribution companies, but primarily from the accounting side – you’d likely need an add-on for advanced inventory. If a distributor’s needs are simple (single warehouse, straightforward sales), Intacct with an inventory add-on might suffice, but NetSuite offers a more unified solution here. Zoho One can also work for small distributors or retailers, using Zoho Inventory for stock management and Zoho Commerce (or integration to Shopify) for online sales. We’ve seen cases like a retail business using Zoho One to handle inventory, invoicing, and customer engagement, resulting in efficiency gains. So, for a small distributor on a budget, Zoho One is workable; for a larger or more complex distributor, NetSuite is likely more fitting.

Manufacturing:

If you are a small manufacturing business, NetSuite stands out as it has a manufacturing module (supporting bills of materials, work orders, production scheduling, etc.) and can integrate the supply chain with financials. There are real-world examples of manufacturers adopting NetSuite to unify their operations. For instance, a high-end camping gear manufacturer used NetSuite ERP to eliminate manual processes and improve customer support. Due to the lack of production modules, Sage Intacct is not typically used as a stand-alone solution for manufacturers; manufacturers would either go with a specialized manufacturing ERP or use Intacct for financials alongside a separate manufacturing execution system (increasing complexity). Zoho One is generally not aimed at manufacturing companies with complex needs. Still, it could support light manufacturing or assembly scenarios (using inventory and maybe Zoho Creator for custom production tracking). Industry-specific case: A food manufacturing small business might leverage NetSuite’s production and quality control features (NetSuite has customers in food & beverage manufacturing), whereas Zoho might not handle quality lot tracking without customization. So, NetSuite’s industry-specific capabilities give it a clear edge for manufacturing SMEs.

Professional Services and SaaS Companies:

Service-oriented businesses (consulting firms, agencies, software companies) often require strong project accounting, time tracking, and billing capabilities. Sage Intacct has carved a niche in professional services and SaaS because of its project accounting module and revenue recognition features (especially with the complexities of subscription billing under standards like ASC 606). For example, Sage Intacct’s ability to handle project financials and integrate with project management tools can be beneficial. There are cases of companies significantly improving their project billing and reporting process with Intacct – e.g., a nonprofit’s use of Intacct’s project module saved them 20+ hours in reporting each cycle

sockeyeconsulting.com (tracking grants and projects efficiently). NetSuite also serves this industry well via its SRP (Services Resource Planning) capabilities, which integrate project management (NetSuite has a Projects module), resource allocation, timesheet entry, and project-based billing. NetSuite SRP can be great for an IT consulting company that needs to manage projects and recognize revenue on milestones. Zoho One offers Zoho Projects for project management and Zoho People for time tracking/HR, which can be combined with Zoho Books for billing – a workable solution for a small agency or consulting firm. A digital marketing agency improved client communication and key performance indicators by 60% using Zoho One’s integrated apps. So, for professional services, if accounting complexity (like advanced revenue deferrals) is high, Sage Intacct or NetSuite might be preferred; if the need is more straightforward and budget is a concern, Zoho One can cover project tracking and basic accounting more affordably.

Nonprofits:

Nonprofits have unique needs like fund accounting, grant management, and strict reporting requirements. Sage Intacct has a strong presence in the nonprofit sector – it allows the use of dimensions for funds, programs, grants, etc., and can quickly produce statements by fund or grant. Nonprofits like charities or associations often choose Intacct to move beyond essential fund accounting software, and Sage Intacct has testimonials of saving significant time (one nonprofit reported saving twenty hours per reporting cycle by consolidating systems with Intacct)

sockeyeconsulting.com. NetSuite also targets nonprofits through its Social Impact program, and it even donates software to eligible nonprofits. NetSuite can be configured for fund accounting and has nonprofit-specific modules (like for donor management), but generally, Intacct’s focus on financials aligns closely with nonprofit needs. Zoho One could be used by nonprofits that need an all-in-one for donor CRM (Zoho CRM), basic accounting (Zoho Books), and marketing (Zoho Campaigns) – smaller nonprofits have adopted Zoho due to cost advantages and the ability to manage everything from one suite. However, Zoho doesn’t inherently handle fund accounting as a concept – creative use of tags or separate accounts might be needed, which is less straightforward. In summary, nonprofits with heavy accounting/reporting demands often lean toward Sage Intacct for its tailored financial features. In contrast, those needing a broader range of tools (and with less complex accounting) might use Zoho One for its CRM + communication capabilities.

E-Commerce and Retail:

For retailers or e-commerce small businesses, NetSuite provides an omnichannel advantage: you can run your online store on NetSuite’s eCommerce module or integrate it with Shopify and manage in-store sales if needed, all feeding into one inventory and accounting system. This unified approach is something growing retailers appreciate to avoid siloed stock counts or financial data. NetSuite’s ability to handle promotions, multiple fulfillment locations, and even point-of-sale (with partners) makes it a strong contender once a retail business reaches a specific size or complexity. Zoho One also caters to retail/e-commerce in a modular way: Zoho Commerce for an online store, Zoho Inventory for stock, Zoho Books for financials, and Zoho CRM for customer loyalty tracking. A small boutique might run entirely on Zoho One and gain a lot of integration (for example, when a customer orders on the website, the CRM, Inventory, and Books are all updated). There are success stories like a cake delivery service using Zoho to improve its process and save time, showcasing how even a tiny e-commerce business benefited from the integrated apps.

On the other hand, Sage Intacct would require a separate e-commerce platform and possibly a retail management system. It’s not typically the hub for retail operations but rather the backend financial ledger. Retailers using Intacct might use it for accounting while using Shopify, Lightspeed, or others for the front end and then integrate the two. That approach can work, but it means more moving parts than an all-in-one solution.

In conclusion, each ERP has industries where it shines: NetSuite is powerful in product-centric and complex businesses (wholesale, manufacturing, retail) due to its comprehensive modules; Sage Intacct excels in financial-centric industries like services companies or nonprofits where accounting is paramount; Zoho One is popular among small tech startups, agencies, and retail businesses that need a bit of everything in one affordable package. Understanding these alignments can help a small business choose a solution that has proven successful in their industry.

Real-World Case Studies and Examples

Looking at how actual companies use these ERP systems can provide practical insight:

Oracle NetSuite Success Stories:

Many fast-growing small and mid-sized businesses have adopted NetSuite to overcome growth pains. For example, XCL Education Group (an education provider), a luxury boutique hotel chain, and a micromobility sharing service all faced issues with fragmented accounting processes, poor visibility into data, and labour-intensive reporting. They turned to NetSuite and found that those challenges were resolved with NetSuite’s unified cloud platform

- afon.com.sg. NetSuite provided them a single source of truth and real-time reporting, simplifying previously complex tasks. Another example is a company like Big Agnes (a camping gear manufacturer), which used NetSuite to replace paper-based processes and scale its customer support and operations. NetSuite’s impact is often seen in time savings and better decision-making. A common theme in case studies is that companies moving from basic software (like QuickBooks or disparate systems) to NetSuite experienced improvements in efficiency and accuracy – for instance, automating revenue recognition, reducing the monthly close time, or enabling e-commerce expansion without adding headcount. NetSuite’s website boasts that more than 41,000 organizations use NetSuite, including many recognizable brands that started small and grew big with NetSuite as their backbone. Such real-world proof points give confidence that while NetSuite can be an investment, it often pays off by supporting growth.

Sage Intacct Case Studies:

Sage Intacct’s case studies frequently highlight improvements in financial visibility and productivity. For instance, Operation HOPE, a nonprofit, used Sage Intacct to leverage AI-driven features and saw significant time savings and accuracy improvements in their financial processes. Another example: a multi-entity organization like CITC (Cook Inlet Tribal Council) consolidated previously separate systems into Sage Intacct, and by using Intacct’s advanced features (like the project module and custom fields), they reportedly saved over 20 hours in reporting time per cycle and made their data much cleaner and readily accessible

- sockeyeconsulting.com Software and SaaS companies are often featured in Intacct’s success stories, citing how Intacct helped them automate subscription billing and SaaS metrics. One SaaS company might mention how integrating Intacct with Salesforce streamlined their quote-to-cash or how real-time SaaS dashboards from Intacct allowed better investor reporting. The pattern is that Sage Intacct delivers strong ROI by significantly reducing manual accounting work (like consolidations, budget vs actual tracking, and invoice processing) and providing actionable financial insight. Customers also mention trust in Intacct’s compliance and audit-ready reports, which are essential in regulated or funded environments. These case studies illustrate that Intacct is not just accounting software but a catalyst for financial maturity in a growing organization – helping small finance teams do more with less time.

Zoho One Success Stories:

Since Zoho One is relatively newer (launched in 2017) than the others, its case studies often emphasize transforming from disjointed apps to an integrated suite. A notable example is The Inspired Companies, which runs three business divisions. They tried many software systems and eventually chose Zoho One to run everything from CRM to finance to operations, achieving better coordination across departments. Another is Little Birdy & Co., a cake delivery service in Australia, which improved its production process and saved time by using Zoho’s apps together. They likely used Zoho Inventory to manage ingredients and Zoho CRM to handle orders and customer communications, all linked together. A digital agency, CKP Creative, reported a 60% improvement in key project KPIs after implementing Zoho One, crediting better client communication and workflow management. These stories demonstrate a key point: Zoho One’s integrated nature can remove the friction between sales, support, accounting, etc., in a small business. Instead of using one tool for email marketing, another for invoices, and another for task management (and struggling to connect data from each), these businesses unified on Zoho One. The result is often greater efficiency, fewer errors (since data doesn’t need to be entered twice in different systems), and cost savings from having a single subscription. Many small businesses also highlight how Zoho One’s affordability allowed them to access tools (CRM, analytics, automation) that they thought were out of reach on a limited budget. The real-world examples of Zoho One users typically emphasize ease of adoption and the empowerment of teams to manage their apps (with a bit of training, a sales rep can customize a CRM report, or a marketing person can build an email journey in Zoho Campaigns, without needing IT in every step).

In summary, the case studies for these ERPs show that NetSuite often shines in cases of operational complexity and scale, Sage Intacct in cases of financial complexity and multi-entity reporting, and Zoho One in cases of needing a cost-effective all-rounder to unify a small business’s operations. These real-world examples underscore the importance of aligning the ERP choice with the company’s key pain points and growth plans.

Cost-Benefit Analysis of NetSuite, Sage Intacct, and Zoho One

When investing in an ERP, small businesses must weigh the costs against the expected benefits:

NetSuite Cost-Benefit:

NetSuite’s costs consist of subscription licensing (base platform + modules + number of users) and implementation services. As noted, base plans start around $999/month for a limited user count, and costs increase with more users and add-ons (CRM, advanced inventory, etc.). This is a significant expense for a small business, often only justifiable if the business is growing fast or has substantial revenue where streamlining operations yields significant returns. Implementation costs for NetSuite can quickly run into tens of thousands of dollars (or more) for a comprehensive setup by an experienced partner. So why spend that? The benefit is the high ROI that can come from automation and insights. NetSuite can replace multiple disparate systems (accounting software, inventory tracking spreadsheets, CRM tools, etc.) with one unified platform, drastically improving efficiency. By automating manual workflows (like order fulfillment, invoice generation, and financial consolidations), NetSuite saves employees time, reduces labour costs, and frees employees to focus on higher-value tasks like business development. NetSuite’s real-time data and analytics help in quicker decision-making and can uncover trends (e.g., identifying a drop in sales in real-time or noticing inventory stock-outs before they become a problem). These improvements can lead to revenue growth (serving customers faster/better, handling more orders with the same staff) and cost savings (fewer errors, less redundant work).

Additionally, NetSuite’s scalability means you won’t need to switch systems as you grow; avoiding a future re-implementation is a benefit. There’s also an intangible benefit of reliability and support. As a product of Oracle, NetSuite comes with 24/7 support and firm security/uptime commitments, giving peace of mind that the business can run on without interruption. In summary, NetSuite is costly but tends to pay off for companies that utilize its breadth – the more modules and processes you put into NetSuite, the better the value you get from that single integrated solution. The cost-benefit analysis often tilts positive when a small business anticipates growth and complexity; NetSuite can handle it, whereas cheaper solutions might falter or require many bolt-ons.

Sage Intacct Cost-Benefit:

Sage Intacct’s subscription cost is generally modular – you pay for the core financials and then extra for additional modules (like project accounting, multi-entity, etc.) or additional users. While not as cheap as entry-level accounting software, Intacct is usually more affordable than NetSuite for a comparable number of users. Implementation services are also typically less costly, given a narrower scope (some small businesses deploy Intacct with the help of a partner for well under $20k if just core finance). The benefit side for Intacct is primarily in finance team efficiency and improved financial accuracy/visibility. For instance, a company might reduce its monthly close from 10 to 5 days by switching to Intacct, saving considerable accounting staff time and enabling management to get financial results faster. Intacct’s automation (like automated approvals, recurring invoices, and AI for outlier detection) can reduce errors and fraud risk. Suppose a business has been doing a lot of tasks manually (spreadsheets for consolidations, manual expense reporting, etc.). Intacct will provide a structured, automated way to handle those in that case, which is a significant benefit. Many Intacct users highlight the ease of compliance and audits – having a proper system means less panic during audit season, indirectly saving costs (auditors bill less when things are organized!). Another benefit is Intacct’s effect on decision-making: with up-to-date financial dashboards, companies can make quicker budget adjustments or spot overspending in a department mid-quarter, not after the fact. If we consider a cost-benefit example, suppose Intacct costs a company $2,000 per month in subscriptions, but it saves one full-time accountant’s worth of work or allows the company to grow 20% without hiring another accountant; that could be a saving or benefit that exceeds the cost. Also, by improving billing and revenue processes, companies might improve cash flow (e.g., invoices go out faster, so cash comes in faster). Opportunity cost is another angle – Intacct frees the finance team to do analysis and strategy instead of chasing numbers, which could lead to identifying cost-saving or revenue-generating opportunities. Overall, Sage Intacct offers a substantial bang for the buck for companies whose pain points are in financial management – it’s not the cheapest, but its relatively moderate cost yields high benefits in financial control and insight. The main caution is if a company’s needs extend beyond accounting; then the cost of required integrations should be added to the analysis. If too many add-ons are needed, the cost-benefit equation might shift, and perhaps a more inclusive system (like NetSuite) could be comparatively better.

Zoho One Cost-Benefit:

Zoho One is exceptionally competitively priced at about $30 per user per month (when all employees are on the plan). For a small business with 10 employees, $300/month for a full suite of 45+ applications is a fraction of the cost of NetSuite or Intacct. Implementation can often be done in-house gradually, so service costs are minimal unless you opt for a consultant to speed things up. The low cost is a huge plus, but what about the benefits? Even if Zoho One provides slightly less sophisticated features, the fact that a small company can get CRM, accounting, inventory, HR, project management, and more in one package is a tremendous value. The benefits include improved collaboration (all your data can be shared across departments easily), elimination of many manual tasks by using integrated apps (e.g., taking a deal won in CRM and automatically turning it into a project and an invoice without re-entering data), and enhanced visibility since Zoho’s apps can talk to each other (giving managers a unified view via Zoho Analytics). A significant benefit of Zoho One often cited is the ability to experiment and innovate – at no extra cost, you can try out applications (like launching your first email campaign through Zoho Campaigns or building a customer survey in Zoho Survey) which you might have hesitated to do if it meant buying new software. This can lead to new growth avenues or operational improvements that wouldn’t have happened otherwise. The ROI on Zoho One can be achieved with even small wins. For example, using Zoho Social to improve your social media presence could bring in new customers, or using Zoho Inventory to avoid stockouts could directly increase sales. Since the monetary cost is so low, the main “cost” to watch is the time/effort to implement and use the tools effectively. If a business doesn’t utilize the apps, even $30/user can be wasted. But in active hands, Zoho One’s benefits far outweigh its cost for most small businesses – it essentially democratizes a lot of technology that used to be enterprise-only. The flexibility to scale up is another benefit; if you hire more employees, adding them to the system is straightforward and cost-effective. And if an app isn’t working for you, you cancel that piece with no significant sunk cost. The only caveat in cost-benefit is that if your business eventually requires very advanced features beyond Zoho’s scope, you might end up layering additional software (which adds cost) or migrating to a different ERP – but many companies find they can go pretty far with Zoho One before hitting those limits.

In conclusion, the cost-benefit analysis can be summarized as follows: NetSuite has a higher upfront cost but potentially massive efficiency and scalability benefits, yielding a strong ROI, especially for complex operations; Sage Intacct has a moderate cost focused on finance, with benefits of automation and insight that often quickly justify the expense for companies drowning in spreadsheets; and Zoho One has low cost and quick-win benefits across various business activities. It is excellent for maximizing value on a budget as long as the business fully leverages the tools.

Integration Capabilities with Third-Party Applications

Integration is a key consideration when comparing ERP solutions, as no system exists in complete isolation. You may have other applications or need to extend the ERP’s functionality. Here’s how our three contenders compare on integration capabilities:

NetSuite Integrations:

NetSuite offers robust integration options as an Oracle product and a mature platform. It has a comprehensive API (SuiteTalk REST/SOAP web services), which developers can use to connect NetSuite with just about any other system. There’s also a tool called SuiteConnect for ODBC connections to reporting tools. NetSuite’s philosophy is often to provide as much in one system as possible. Still, in practice, integrations are standard – for example, connecting NetSuite to an external eCommerce platform like Magento or to a specialized logistics system. Many small businesses use integration platforms like Celigo, Boomi, or Mulesoft, which have pre-built NetSuite connectors to speed up integration development.

Additionally, the SuiteApp marketplace provides many ready-made third-party extensions that plug directly into NetSuite accounts (for instance, apps for tax calculations like Avalara or for HR like SuitePeople if not using NetSuite’s own). NetSuite supports event-based integrations, too – you can set up workflows/scripts that trigger when records are created or updated, allowing real-time data to be pushed to other systems. The key takeaway is that NetSuite can integrate with most external software, given the right tools. However, these integrations can require technical expertise to set up and maintain, which is why working with experienced integration specialists is common. On the simpler side, NetSuite also has native integration with products like Salesforce (for those who use Salesforce CRM with NetSuite ERP) and has an integration framework called SuiteFlow for building custom process integrations without heavy coding. So, if you have an existing software ecosystem, NetSuite will likely fit in one way or another – plan for the integration project. One limitation noted by some is that heavy integrations can incur additional costs or complexity, but once set, they tend to run smoothly on the reliable NetSuite cloud.

Sage Intacct Integrations:

Sage Intacct’s strategy is often described as a “best-in-class, not all-in-one” approach. This means they expect customers to integrate other specialized systems. As a result, Intacct provides a well-documented API for developers and has an ecosystem of partners. A widespread integration is Salesforce CRM to Intacct, which Sage facilitates with a pre-built connector (so sales orders from Salesforce can generate invoices in Intacct, etc.). Intacct also has integration partners for expenses (e.g., Expensify or Nexonia to Intacct) and payroll/HR (since Intacct doesn’t do payroll, many integrate ADP or Paychex).

Additionally, because Intacct focuses on finance, their API is designed to get data in/out for those transactions reliably. Intacct’s marketplace (Sage Intacct Marketplace) lists many third-party solutions with certified integrations, including inventory management, budgeting software, tax compliance, and more. This gives small businesses the flexibility to assemble a tailored software stack. The challenge is that integration itself can be a hurdle. As noted earlier, some users find connecting Intacct with multiple apps complex and require technical help. However, Sage has been improving in this area with more out-of-the-box connectors. Another integration capability is using iPaaS (Integration Platform as a Service) tools like Workato or Zapier for more straightforward needs. For example, if you want a Google Sheets update every time a particular entry is made in Intacct, you could achieve that via such tools.

In summary, Sage Intacct is built to “play well” with others rather than do everything itself. As long as a small business anticipates the need for those connections and possibly budgets for integration (either through a partner or internal developer effort), Intacct can fit into an integrated application environment. The benefit of this approach is you’re not locked into one vendor for all functionality; the drawback is you have multiple systems to maintain.

Zoho One Integrations:

Zoho One’s strength lies in its internal integration – the apps within Zoho One are already unified to a large degree. But inevitably, a business might have to integrate with external systems (perhaps a legacy system or a third-party service not offered by Zoho). Zoho provides several means to integrate. First, almost every Zoho app has an API, so developers can connect external apps to Zoho (for example, integrating a proprietary point-of-sale system with Zoho Books for daily sales entries). Second, Zoho has an integration platform called Zoho Flow (similar to Zapier), which is included in Zoho One and allows the creation of automated workflows between Zoho apps and 3rd-party apps. Zoho Flow has many pre-built connectors, so you can easily do things like, “When an order is placed in Shopify, create a customer and invoice in Zoho Books” if a direct integration doesn’t exist.

Additionally, Zoho Marketplace offers extensions – some of which integrate external services into Zoho applications (for instance, there might be a Zoom integration for Zoho Meetings, etc.). Popular software such as Zoho often has native connectors; for example, Zoho Books can integrate with Stripe or PayPal for payments. Zoho CRM has native integration with telephony systems and social media. If using email services, Zoho integrates with Gmail/Outlook calendars, email, etc. The key is that Zoho One covers so many functions internally that the need for third-party integration is reduced, which is a significant advantage for small businesses that don’t have an IT team. However, Zoho’s tools (APIs, Zoho Flow, Marketplace extensions) are usually sufficient to connect most common apps when needed. For instance, if a small manufacturer uses Zoho One but has a separate CAD system for design, they might use Zoho’s API to link it or simply export/import data as needed. One area where integration might be needed is specialized industry software – Zoho might not have a specific module for dental practice management. Still, a dental clinic using Zoho could integrate its practice system with Zoho CRM for marketing purposes.

In conclusion, Zoho One is quite integration-friendly and even provides the integration platform at no extra cost. Still, importantly, many users might not need to use it extensively because of the suite’s comprehensive coverage. This reduces the overall integration workload and is a clear benefit for small operations that want to minimize technical headaches.

Choosing the Right ERP: Final Thoughts

Selecting “NetSuite vs Sage vs Zoho One” for a small business matches the ERP’s strengths with your business’s priorities. Here’s a quick recap and guidance:

Choose Oracle NetSuite

if your small business is growing rapidly or already has complex, multi-faceted operations that would benefit from a single, unified system. NetSuite is best for those who need deep functionality across all departments – accounting, inventory, sales, eCommerce, and more – and are prepared to invest in a robust solution for long-term scalability. The cost is higher, but so is the potential payoff in efficiency and automation. NetSuite shines in product-based businesses, multi-entity companies, and any organization anticipating going from “small” to “mid-size” shortly. With an experienced implementation partner, even a tiny company can successfully deploy NetSuite and start reaping benefits like real-time visibility and streamlined workflows. Just ensure you have the budget and commitment for the project. (Learn more about NetSuite solutions and how they fit small businesses on the Haya Solutions NetSuite page.)

Choose Sage Intacct

if your primary pain points revolve around financial management and accounting, especially if you need strong controls, compliance, and detailed reporting more than a fully unified operational system. Sage Intacct is an excellent choice for finance-centric organizations – for example, professional service firms, consultancies, nonprofits, and SaaS startups that require advanced accounting (revenue recognition, project accounting, multi-entity consolidation) without the overhead of an entire ERP. Intacct can give you quick wins by automating your accounting processes and delivering insights at a moderate price point. It’s also a good fit if you’re comfortable maintaining a couple of systems (like a separate CRM) and integrating them rather than one system for everything. Essentially, if you want top-tier cloud accounting with the flexibility to integrate other apps as needed, Intacct provides that balance. Just be mindful of its scope – outside of finance, you’ll rely on other tools. Sage Intacct can be a stepping stone for small businesses that have outgrown essential accounting software but aren’t ready for something as expansive as NetSuite. (You can read more comparisons between Sage Intacct and NetSuite on the Haya Solutions blog which discusses why some businesses switch to NetSuite.)

Choose Zoho One

if you are a small business or startup looking for maximum value and breadth on a limited budget. Zoho One is ideal when you want to quickly put in place a wide range of business systems (CRM, HR, accounting, etc.) that work together without a substantial upfront cost. It’s particularly well-suited for small teams that must wear many hats – Zoho One’s apps can reasonably support each function. It’s also great for businesses prioritizing ease of use and quick implementation. If you have basic needs across multiple areas and prefer a one-stop-shop approach, Zoho One will likely cover your requirements. Typical examples include small e-commerce companies, agencies, marketing firms, consultancies, or even local service businesses (like a chain of clinics or a training company) that must manage customer interactions, scheduling, billing, and marketing in one package. While Zoho One might not have every advanced feature out-of-the-box, combining its 45+ apps and the ability to customize with Zoho’s platform can take you quite far. The cost-benefit is firmly in its favour for most small deployments – even if you only use 5 or 6 of the apps actively, it often justifies the price. As your business grows, you can use more of Zoho’s apps or integrate selectively with external solutions if needed. (For a deeper dive into Zoho One’s capabilities, you might check out Haya Solutions’ article on Zoho One as an all-in-one business solution, highlighting its features and affordability.

Conclusion:

In an apples-to-apples comparison, NetSuite offers the most comprehensive ERP functionality, Sage Intacct delivers exceptional accounting and financial management, and Zoho One provides unparalleled breadth at a low cost. Small businesses should assess their current challenges and growth trajectory. It may be helpful to consult with ERP experts or partners (for example, Haya Solutions specializes in NetSuite and Zoho implementations, providing an unbiased perspective on what fits your situation best) to evaluate which solution aligns with your business strategy. Remember, the “best” ERP is the one that addresses your needs effectively and provides a platform for growth. With the information in this guide, you’re better equipped to make an informed decision and set your small business on the path to streamlined operations and success.